Get the free tav offsetting shall refer to tav the outstanding mpl obligation

Fill out, sign, and share forms from a single PDF platform

Edit and sign in one place

Create professional forms

Simplify data collection

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

How to complete the offsetting of Pag-IBIG form form

TL;DR - How to fill out a offsetting of Pag-IBIG form form

To complete the offsetting of Pag-IBIG form, ensure you gather all necessary information such as your Employer Business Name, Pag-IBIG Employer ID Number, and Registration Tracking Number. Proceed to fill the application correctly, highlighting your reason for the penalty and following the specified guidelines. Don’t forget to review your document and eSign using tools like pdfFiller for a streamlined process.

What is the Pag-IBIG penalty discount application?

The Pag-IBIG penalty discount application is a program aimed at assisting employers with penalties incurred for non-compliance regarding member contributions. Understanding the penalty discount program is critical, as it offers a chance to reduce financial obligations while promoting timely and accurate remittance of contributions.

-

Overview of the penalty discount program: It allows for forgiveness of penalties under certain conditions laid out by Pag-IBIG.

-

Importance of timely registration and remittance: Late payments can lead to penalties, which this program helps to alleviate.

-

Who can apply for the penalty discount? Typically, employers who have outstanding obligations and wish to maintain compliance.

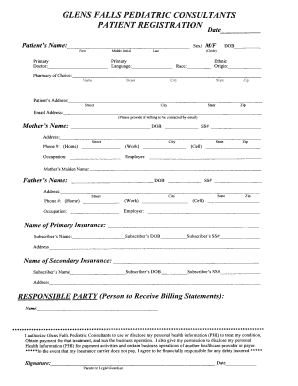

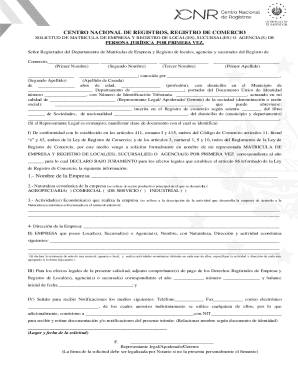

How do fill out the application for penalty discount?

Filling out the application correctly is crucial to avoid delays or rejections. It is essential to have all relevant details on hand before starting.

-

Filling out Employer Business Name: Ensure the legal name matches registration documents.

-

Providing Pag-IBIG Employer ID No.: This uniquely identifies your business within the Pag-IBIG system.

-

Entering the Registration Tracking Number: Input the correct number to track your application.

-

Detailing Employer Business Address: Must be precise to facilitate communication.

-

Specifying Dates: Filed vs. Registration: Indicates when documents were submitted vs. being registered.

-

Declaring the Start of Business Operation: This date influences your eligibility for discounts.

What are the key application fields?

Understanding the critical fields in your application can significantly improve your chances of approval.

-

Reason for Failure to Register: Clearly state why contributions were not made on time.

-

Covered Employees and Remittance Status: Indicate all employees that contribute and their remittance records.

-

Assessment of Previous Penalty Condonation: Disclose any past applications that could impact your current request.

-

Agreement section: understanding your commitments regarding future payments.

-

Signature Requirements for Authorized Representatives: Ensure someone directly authorized signs the application.

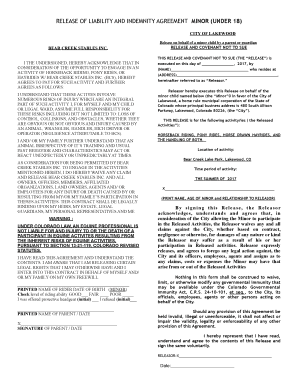

What are the essential guidelines for applicants?

It’s paramount for applicants to comply with all Pag-IBIG guidelines to avoid denial.

-

Understanding the legal implications of misrepresentation: False information can lead to legal consequences and denial.

-

Overview of Pag-IBIG Fund's rights on application review: They can request additional information or reject if not compliant.

-

Compliance with rules and regulations for penalty schemes: Stay informed on current rules to ensure eligibility.

-

Potential outcomes of non-compliance: Includes penalties, increased dues, and possible legal action.

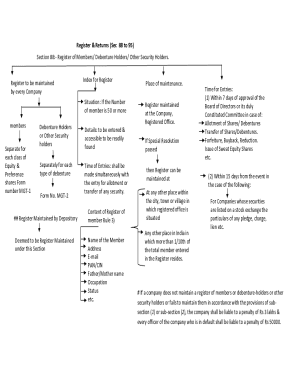

How can calculate my total provident obligation?

Understanding your financial obligations under the Pag-IBIG Fund is essential for future planning.

-

Components of total unremitted membership savings: This includes all unreported contributions.

-

Assessing deprived dividends and penalties: Calculating what you owe based on missed payments.

-

Understanding TAP: Total Assessed Penalties: Know how much additional fees you might incur.

-

Payments Made: Initial Payment and Discounts Approved: Track your paid amounts to demonstrate compliance.

What payment options are available?

Choosing your payment strategy can greatly affect your financial management.

-

Understanding the benefits of full payment: Reduces total penalties and assures compliance.

-

Explaining the installment payment option: Allows for manageable payment periods.

-

Clarifying the number of installments available: Be informed of frequency and terms to plan effectively.

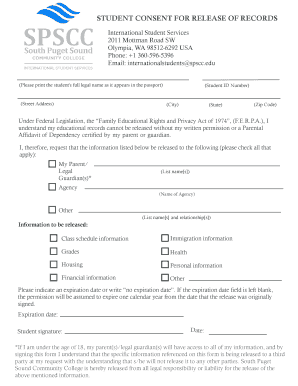

How can pdfFiller streamline my application process?

Using tools like pdfFiller can simplify the way you manage your Pag-IBIG documents.

-

How to edit and fill the Pag-IBIG form using pdfFiller: Accessible editing tools make filling easy.

-

Steps to securely eSign your application: Streamlines submission and authentication.

-

Collaborating with your team on document management: Enables multiple users to work on an application.

-

Accessing documents from anywhere with pdfFiller: Flexibility in document management enhances productivity.

What is the Pag-IBIG Fund review process like?

Knowing what happens after submission can alleviate concerns about your application.

-

What happens after submission of your application? A review period followed by potential requests for more info.

-

Tracking your application status with pdfFiller: Easy monitoring of your application journey.

-

Common reasons for application denial: Missing information is a frequent cause of rejected applications.

What are the post-submission steps?

After applying, it's essential to maintain vigilance over potential follow-ups.

-

What to do after applying for the penalty discount: Keep documentation handy for any inquiries.

-

Preparing for potential audits or inquiries from Pag-IBIG: Stay organized to facilitate any requests.

-

Maintaining compliance in future remittance processes: Continue to meet remittance deadlines.

Frequently Asked Questions about offset loan the ones without this feature form

What is the Pag-IBIG penalty discount program?

The Pag-IBIG penalty discount program allows employers to apply for the reduction or forgiveness of penalties incurred due to late remittances. This program aims to promote compliance among employers.

How do I track the status of my Pag-IBIG application?

You can track your Pag-IBIG application status through pdfFiller by logging into your account. Regular updates are provided until the application is approved or rejected.

What documents do I need for the Pag-IBIG penalty discount application?

You'll need your Employer Business Name, Pag-IBIG ID No., Registration Tracking Number, and proof of previous remittances. Having all documents ready speeds up the application process.

Can I file an application if I missed the deadline?

Yes, you can still file for a penalty discount after missing a deadline. However, you must provide a valid explanation for the late submission.

What will happen if my application is denied?

If your application is denied, you will receive a notice detailing the reasons. You may address these issues and reapply if appropriate.

pdfFiller scores top ratings on review platforms